kentucky transfer tax calculator

In the case of any deed not a gift the amount of the full actual consideration therefor paid or to be paid including the amount of any lien or liens thereon. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all.

. Kentucky VIN Lookup Vehicle Tax paid in 2021. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. If the deed is a gift or indicates nominal consideration the tax is paid on the estimated price the property would bring in an open market.

General Administration and Program Support. For comparison the median home value in. On any amount above 400000 you would have to pay the full 2.

In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. In the case of a gift or any deed with nominal consideration or without stated consideration the estimated price the property would bring in an. That means they are subject to the full income tax at a rate of 5.

The Benefit Estimator does not calculate service credit with another state-administered retirement system. The tax rate is the same no matter what filing status you use. Education417807 Medicaid111644 Category Percentage.

It is levied at six percent and shall. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. This tax is collected upon the transfer of ownership or when a vehicle is offered for registration for the first time in Kentucky.

The tax is computed at the rate of 50 for each 500 of value or fraction thereof. 072 of home value Tax amount varies by county The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year.

Kentucky has a 6 statewide sales tax rate but also. Whether you are already a resident or just considering moving to Crestwood to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kentucky local counties cities and special taxation districts.

The transfer tax is imposed upon the grantor The tax is computed at the rate of 50 for each 500 of value or fraction thereof. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Actual amounts are subject to change based on tax rate changes.

The Kentucky income tax calculator is designed to provide a salary example with salary deductions made in Kentucky. Where can I find my Vehicle Identification Number VIN. For individuals who became members of KTRS prior to July 1 2008 the minimum retirement eligibility is 27 years Kentucky service or age.

Tax Calculator Tax Calculator Instructions. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate.

Kentucky Property Taxes Go To Different State 84300 Avg. Kentucky imposes a flat income tax of 5. Property Information Property State.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price.

After a few seconds you will be provided with a full breakdown of the tax you are paying. The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. For most counties and cities in the Bluegrass State this is a percentage of taxpayers. Overview of Kentucky Taxes.

As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000. Minimum Retirement Eilgibility -- 27 years Kentucky service or age 60 with 5 years of service credit. Kentucky Capital Gains Tax.

Kentucky Cigarette Tax. Serving the Greater Area of Indiana Kentucky and Ohio. Calculator Mode Calculate.

It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. This is still below the national average. Please enter the VIN.

Capital gains are taxed as regular income in Kentucky. All rates are per 100. Since 2001 Stewart Title has partnered on real estate transactions with customers in Columbus Terre Haute Lexington and other communities throughout the Ohio River Valley in Indiana Kentucky and Ohio.

Crestwood together with other in-county public districts will calculate tax levies separately. Citizen Tax Calculator Enter your state individual income tax payment Select an Income Estimate OR 417807 111644 138828 79679 69640 182402 Education Medicaid Postsecondary Education Human Serv. The base state sales tax rate in Kentucky is 6.

Tax Estimator Assessment Value Homestead Tax Exemption Check this box if this is vacant land Please note that this is an estimated amount. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Denotes required field.

For example on a 500000 home a first-time home buyer would have to pay 400000 75 100000 2 3200 in transfer taxes. When added together the property tax load all owners bear is. On the drivers side of the dashboard viewable through the windshield in the Drivers side door jamb looks like a sticker.

The tax estimator above only includes a single 75 service fee. In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded in or 90 of the manufacturers suggested retail price MSRP including. Justice All Other NoteThis calculator is for illustrative purposes only.

Select your district below for district tax rates then enter your assessed value to see results. Weve helped people find homes and build futures here because we understand how. Search tax data by vehicle identification number for the year 2021.

You can find the VIN.

Somerset Real Estate Somerset Ky Homes For Sale Zillow

Cryptocurrency Taxes What To Know For 2021 Money

Transfer Tax Calculator 2022 For All 50 States

What Are The Seller Closing Costs In Kentucky Houzeo Blog

Kentucky Real Estate Transfer Taxes An In Depth Guide

Transfer Tax Alameda County California Who Pays What

What Is A Homestead Exemption And How Does It Work Lendingtree

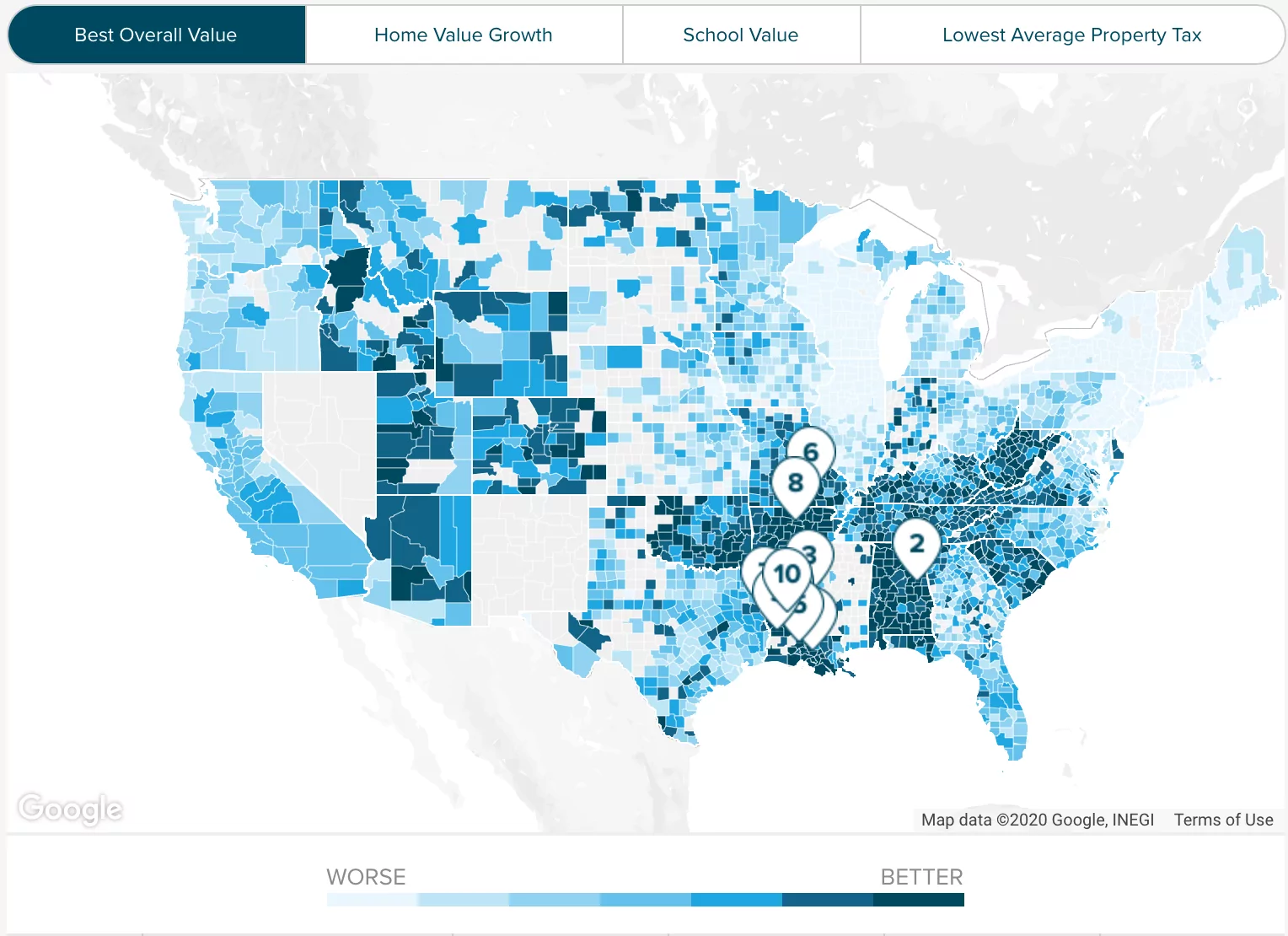

Jefferson County Ky Property Tax Calculator Smartasset

Our Land Transfer Tax Calculator Is Based By Province To Find Out How Much Land Transfer Tax To Calculate In To Your Budget How To Find Out Transfer Budgeting

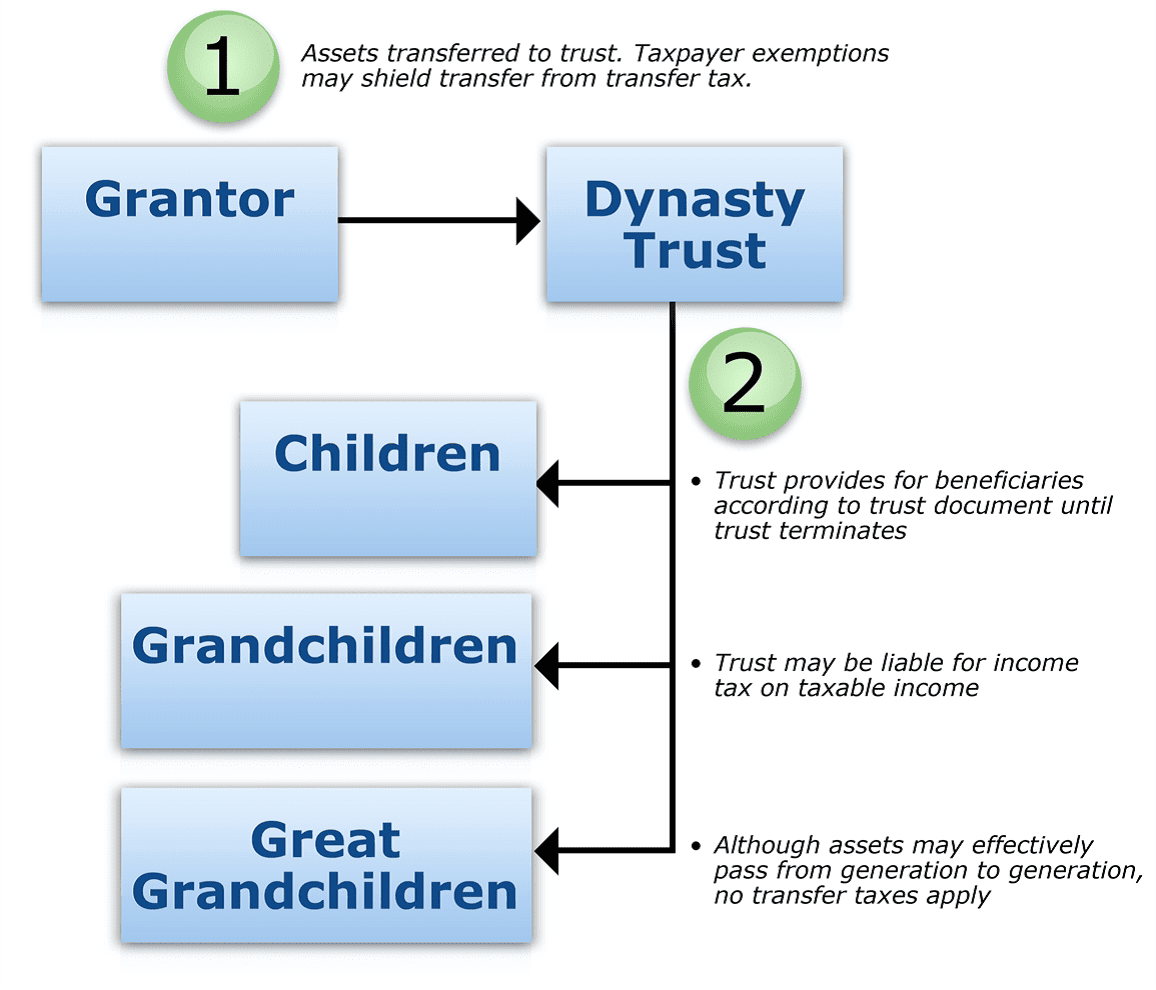

Is Your Legacy In A Dynast Trust Cwm

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Michael Stuart Webb Barrie Real Estate Land Transfer Tax

What You Should Know About Contra Costa County Transfer Tax

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Transfer Tax In San Luis Obispo County California Who Pays What

Who Pays What In The Los Angeles County Transfer Tax

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Canada Rental Property Rental Property Management Income Property