mobile al sales tax registration

Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types. Ad New State Sales Tax Registration.

The manufactured homeowner shall immediately attach.

. Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd. Tax Application Form information registration support. If you are currently setup to Electronically File State of Alabama SalesUse Taxes online step by step instructions for adding Montgomery County to your online filing through the.

Revenue Office Government Plaza 2nd Floor Window Hours. Sales Use Tax Division. The Revenue Department administers the Privilege License Tax Ordinances of the City of Mobile which involves collection of monthly Sales Use Taxes and licensing.

Simplify the sales tax registration process with help from Avalara. However However pursuant to Section 40-23-7. Application to Address the City Council.

The current total local sales tax rate in Mobile County AL is 5500. 30 penalty will be assessed beginning March 1st. Street Renaming Policy and Application.

In Mobile Downtown office is. You may request a price quote for state-held tax delinquent property by submitting an electronic application. 800 to 300 Monday Tuesday Thursday and Fridays and.

While alabamas sales tax generally applies to most transactions certain items have special treatment in many states when it. Application for Certificate of Public Convenience and Necessity. Ad New State Sales Tax Registration.

800 to 300 Monday Tuesday Thursday and Fridays and. Once you register online it takes 3-5 days to receive an account. Revenue Office Government Plaza 2nd Floor Window Hours.

Ad New State Sales Tax Registration. Business Tax Online Registration System. Per 40-2A-15h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may.

Tax Application Form information registration support. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as. Once your price quote is processed it will be emailed to you.

2 Choose Tax Type and Rate Type that correspond to the taxes being reported. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as.

Mobile AL 36652-3065 Office. Mobile AL 36652-3065 Office. 15 penalty will be assessed beginning February 1st through February 28th.

Mobile county al sales tax registration Wednesday June 15 2022 Edit Any tax liens remaining unsold after the auction or sale shall be included in future tax lien auctions or. Ad New State Sales Tax Registration. In Mobile or our Downtown Mobile office at 151 Government St.

Ad Fill out one form choose your states let Avalara take care of sales tax registration. Please call the Sales Tax Department at 251-574-4800 for additional information. Alabama Department of Revenue.

3 If you are an established. Applicable interest will be assessed beginning February. Sales Use.

Be A Part Of World Free Tax Zone Register Your Company Today Business Management Economic Department Services Business

Myusacorporation Europe Services And Pricing S Corporation Country Flags Interactive

Unified Infotech On Behance Sales Tax Pals Tax

How To Calculate Sales Tax For Your Online Store

How To Calculate Sales Tax For Your Online Store

How To Charge Shopify Sales Tax On Your Store July 2022

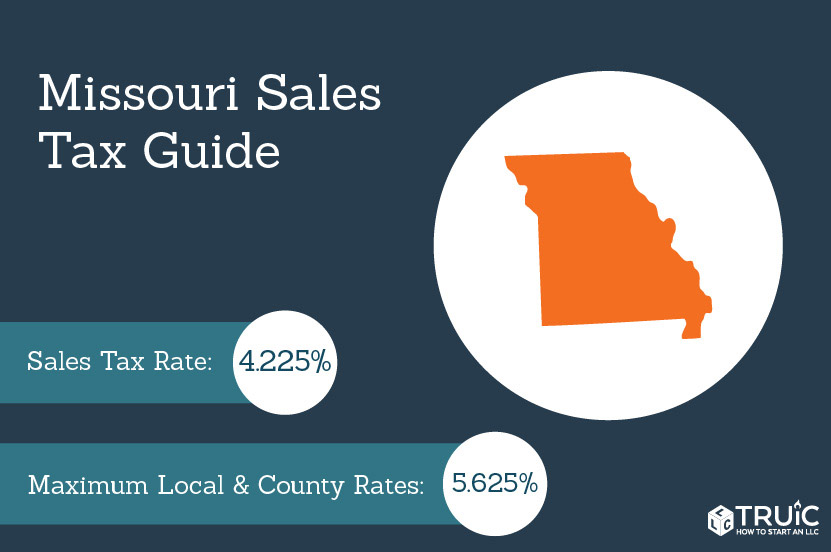

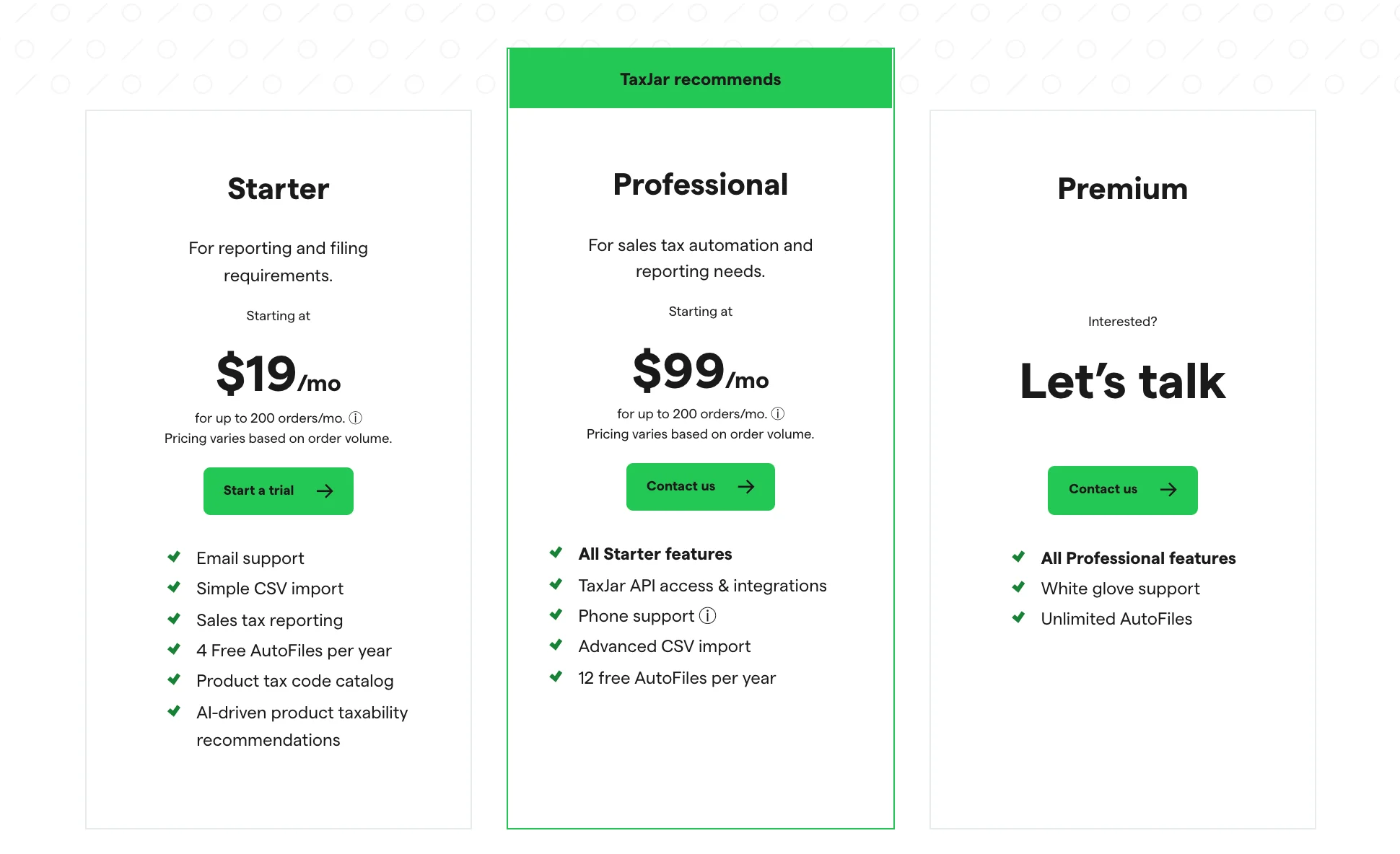

What Is Sales Tax A Complete Guide Taxjar

Sales Tax By State Is Saas Taxable Taxjar

How To Charge Shopify Sales Tax On Your Store July 2022

How To Charge Shopify Sales Tax On Your Store July 2022

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com

Should You Be Charging Sales Tax On Your Online Store Backoffice

Should You Be Charging Sales Tax On Your Online Store Backoffice

Setting Up Manual Tax Rates In Squarespace Commerce Squarespace Help Center

Sales Tax Guide For Online Courses

States With Highest And Lowest Sales Tax Rates