fha gift funds limit

FHA loan amount. This gift is to be used to cover the borrowers down payment.

Fha Gift Funds How Can I Use Them To Buy A Home

All of your down.

:max_bytes(150000):strip_icc()/rules-for-documenting-mortgage-down-payment-gifts-4157907-FINAL-9c59d5c0b3e445e1a142b323f35176e1.png)

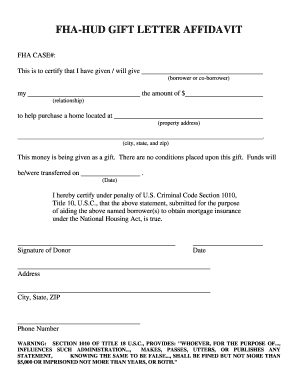

. FHA Loan Rules For Gift Funds FHA News and Views FHA loan rules in HUD 40001 have specific guidelines where gift funds to the borrower are concerned. The seller is allowed to pay up to 6 of the sales price toward the home-buyers closing costs and prepaid. In our last blog post we answered a reader question about whether its acceptable to receive gift funds from a family member for an FHA borrowers down payment.

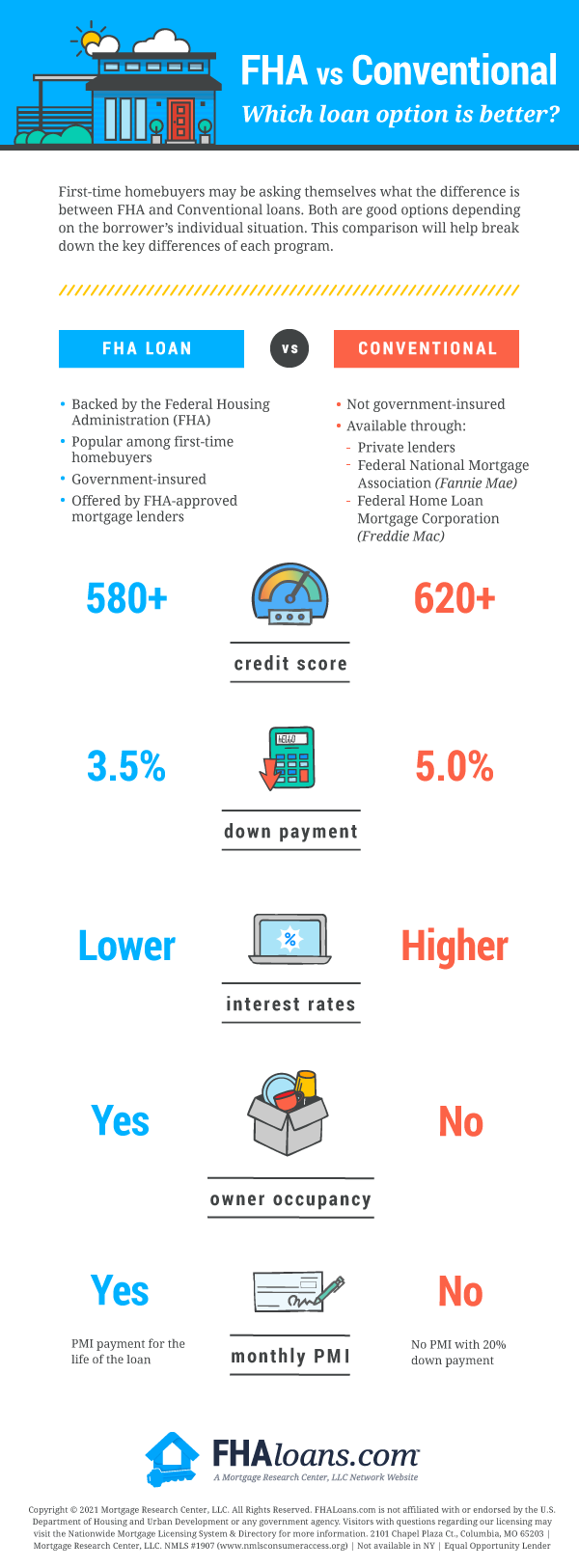

January 26 2017. FHA loans requires that borrowers who receive a Gift of Equity must have a minimum down payment of 35 percent of the homes. The short answer is yes in 2019 the minimum required down payment for an FHA loan which is 35 can be gifted from a family member a friend an employer or some other approved.

When a borrower applies for an FHA home loan a down payment is required for all transactions. 289500 This could mean that buyers essentially can purchase a home with no cash down payment thanks to the sellers discount. Borrowers with a credit score of 500 579 need a down payment of at least.

This is providing the equity. GCA Mortgage Mortgage Experts With No Overlays. FHA Loans Gift Funds and Inducements to Purchase.

Fha Loans Requirements Down Payment Fha Limits Texas Average Fha Loan Rate The average mortgage interest rates rose slightly this week across the. FHA loan rules in HUD 40001 have specific guidelines where gift funds to the borrower are concerned. FHA loans do not.

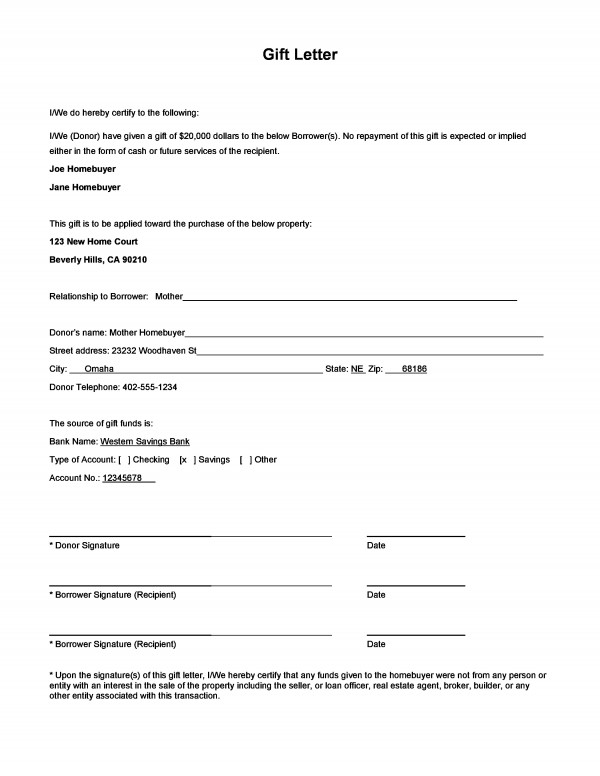

The portion of the gift not used to. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower. The FHA Gift Fund can be used for both the down payment and closing costs on your home.

Borrowers with a credit score of 580 or higher need 35 of the homes value as a down payment. If you have applied for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient acknowledging the warning stated in that section. Its worth noting that the lender is allowed to offer the borrower closing cost assistance as long as the aid does not exceed 6 of the sales price and stays within the total 6 limit.

The minimum amount you can receive as a gift is 500 and there is no maximum. Gift funds are commonly used for home loan expenses. HSH funds the program which costs.

The FHA Federal Housing Administration is the easiest path to homeownership. If the gift and giver meet certain FHA requirements gift funds can be used as a down payment. Here are some guidelines when using a gift fund for FHA.

Gift Money For Down Payment Free Gift Letter Template

Fha Raises Loan Limits For 2022 Guaranteed Rate

What Are The Gift Limits On A Home Loan House Team

How To Use A Mortgage Gift Fund For Your Down Payment Edina Realty

Fha Vs Conventional Loan Is There A Difference

Mississippi Fha Lenders Ms Fha Loans 2022 Fha Lenders

Gift Letter Affidavit Form Fill Out And Sign Printable Pdf Template Signnow

Fha Eliminates Two Unnecessary And Outdated Lending Roadblocks Fha Fha Loans Eliminate

Rules For Giving And Receiving Home Down Payment Gifts Bankrate

Giving Or Receiving A Down Payment Gift Here S What You Need To Know

The Rules For Fha Down Payment Gifts

How To Use A Gift Letter For A Home Down Payment

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

How To Use Gifted Funds For A Mortgage Down Payment

Fha Down Payment And Gift Rules Still Apply

Fha Loan Rules On Down Payment Assistance Gift Funds

Down Payment Gifts And How To Use Them

Gift Funds When Is A Gift A Gift According To Fha

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Gift Letter