december child tax credit 2021

PT 6 min read If you havent received your child tax credit check it could be late. Capitol July 15 2021 in Washington DC.

Child Tax Credit Is December The Final Check Deseret News

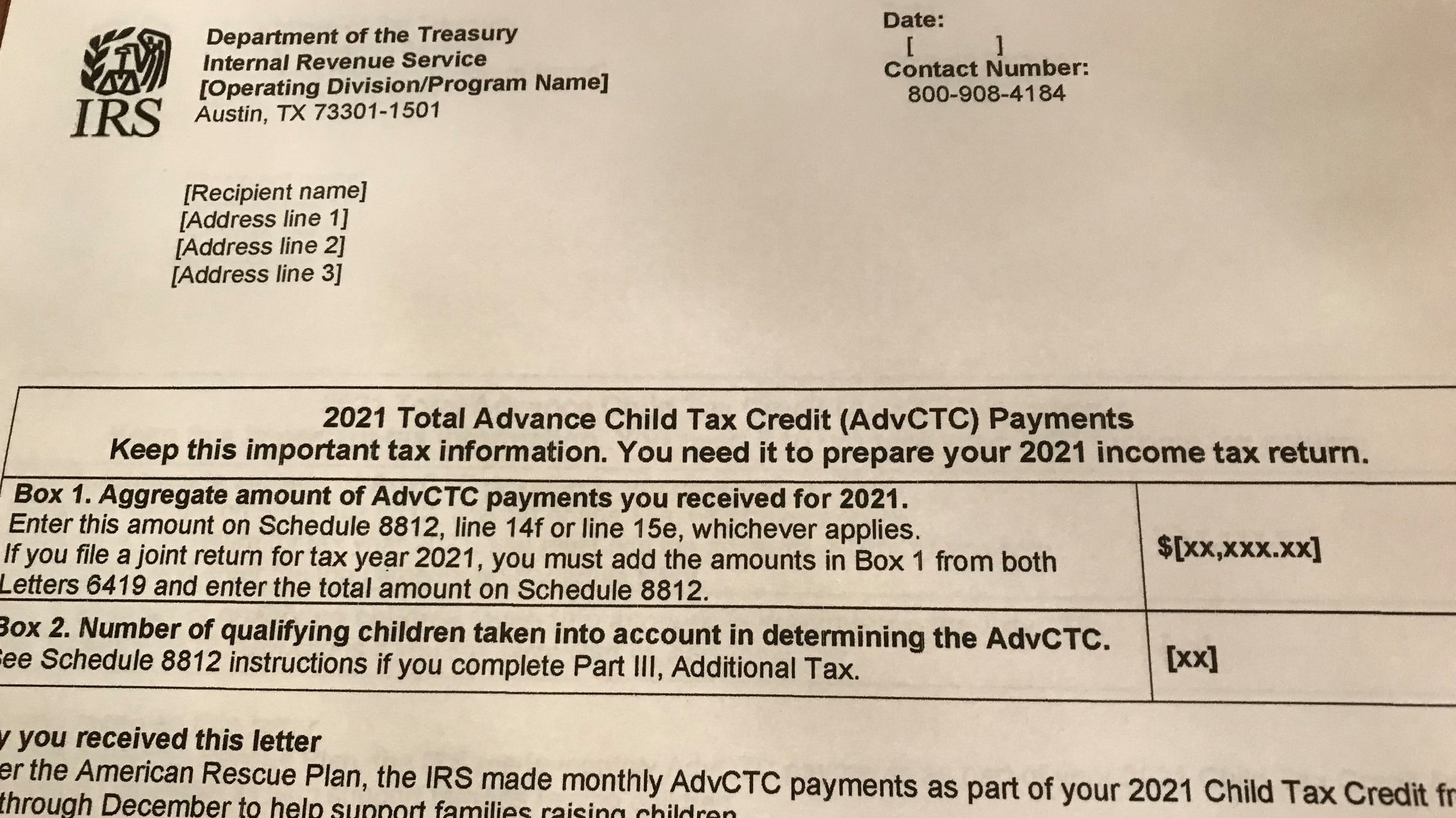

If the IRS says the December 2021 child tax credit payment has been made but the money doesnt show up there is a way to trace it.

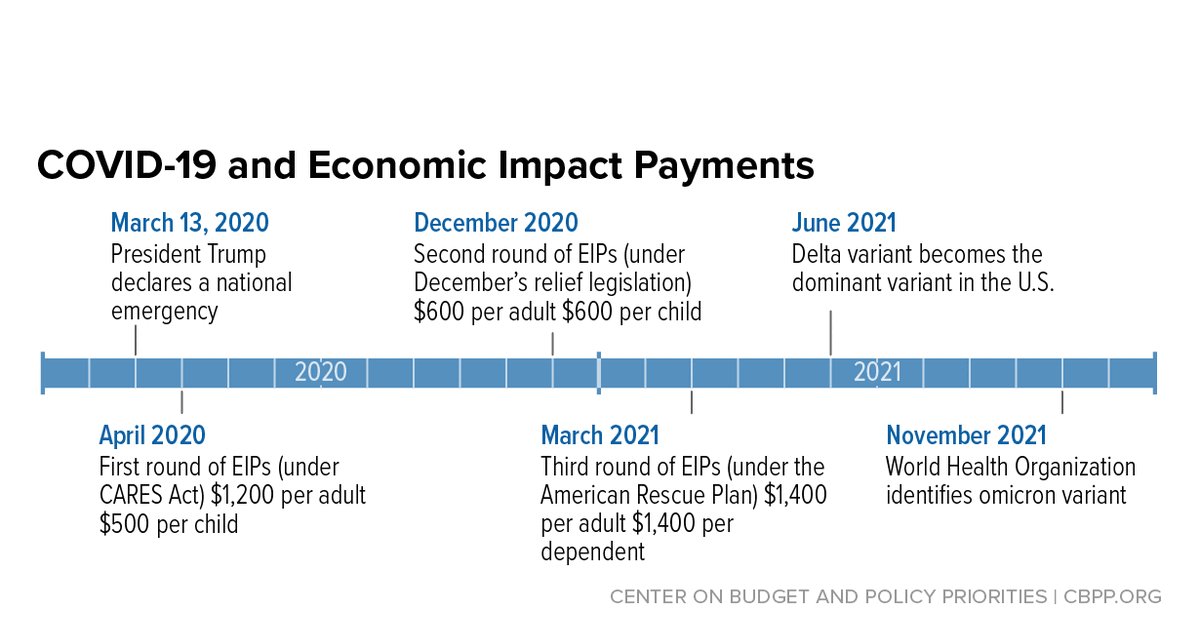

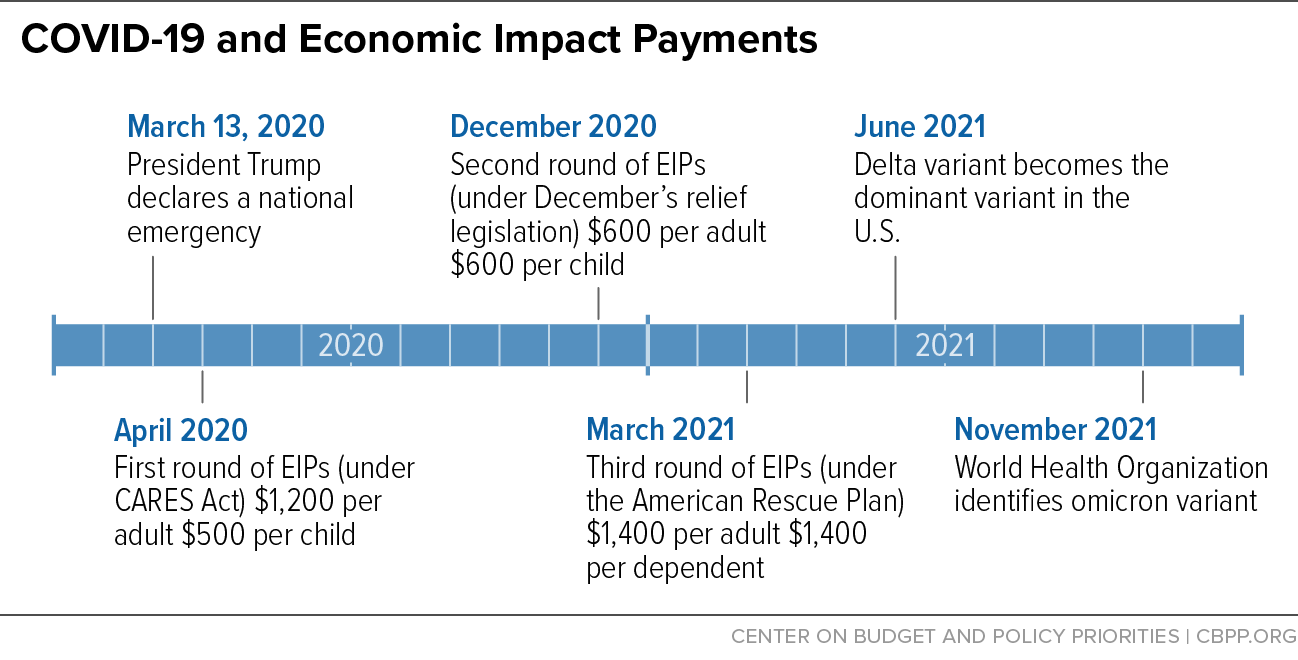

. Eligible families who did not. December 15 2021 830 AM MoneyWatch Millions of Americans have weathered the COVID-19 pandemic with the help of direct cash payments from the US. Families will receive the other half when they submit their 2021 tax return next season.

Sarah TewCNET The monthly child tax credit payments have come to. While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of. The final payment under the.

Thats because the expanded CTC divided the benefit between monthly checks issued starting in July and ending in December with the other half to be claimed on tax returns. The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between. Claim the full Child Tax Credit on the 2021 tax return.

Starting July 15 families will start receiving monthly payments as high as 300 per child as part of the new expanded child tax credit. The current child tax credit has been distributed in monthly payments of either 250 or 300 for each eligible dependent child depending on age and income. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

Democrats beefed up the child tax credit to a maximum of 3600 for each child up to age 6 and 3000 for each one ages 6 through 17 as. The Child Tax Credit is a fully refundable tax credit for families with qualifying children. To get money to families sooner the IRS will send families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the.

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. It also provided monthly payments from July of 2021. This means that the total advance payment amount will be made in one December payment.

Simple or complex always free. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. In total the expanded credit provides up to 3600 for each younger child and up to.

Child tax credit for baby born in December 21 The total child tax credit of 10500 is correct. Senate Majority Leader Chuck Schumer D-NY at a press conference on the Child Tax Credit at the US. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

If you took advantage of the advance child tax credit payments in 2021 your family was allowed to receive 50 of your estimated credit from July through December. Bigger child tax credit for 2021. The Child Tax Credit allowed you to deduct 2000 for each qualifying child dependent under age 17 under the terms in place in tax years 2018 through 2020.

The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help. Keep in mind that these are advance payments for tax year 2021 which is equal to half the total benefit. You have a balance of 6900 for your older children plus 3600 for the newborn.

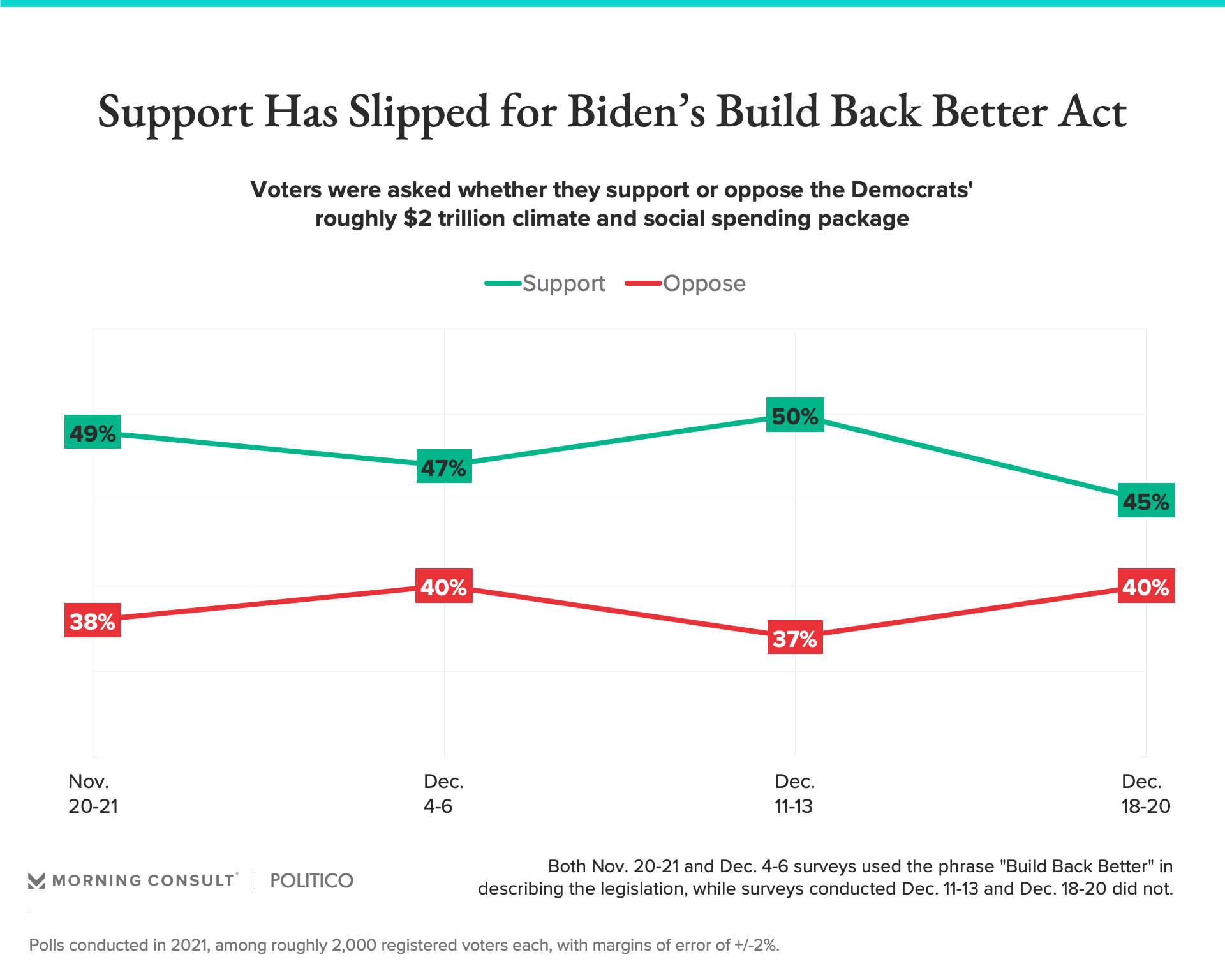

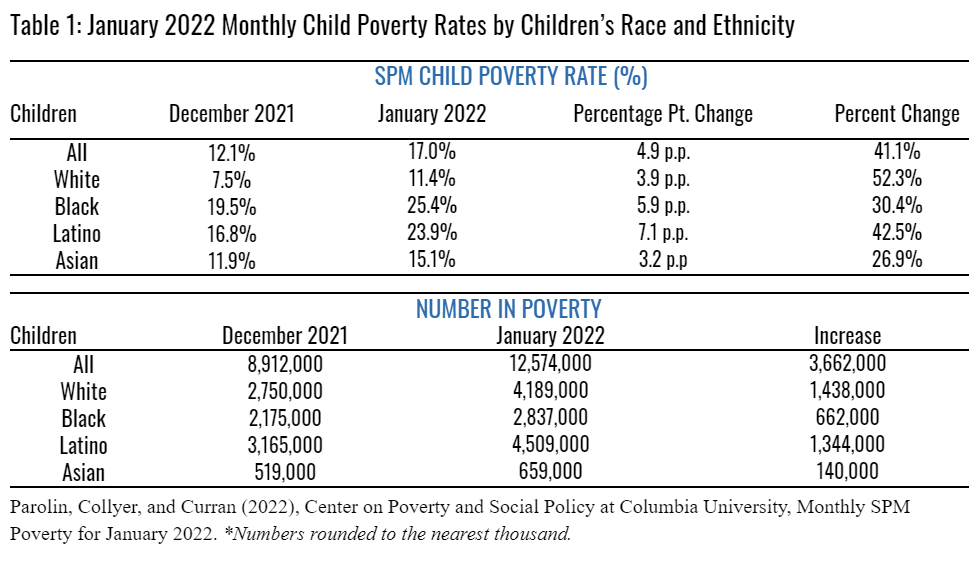

The Child Tax Credit provides money to support American families. But patience is needed. In absence of a January payment though the monthly child poverty rate could potentially increase from 121 percent to at least 171 percent in early 2022the highest.

File a federal return to claim your child tax credit. The advance Child Tax Credit payments began going out to tens of millions of eligible households in mid-July and are being paid in up to six monthly installments through. Here is some important information to understand about this years Child Tax Credit.

The new system is part of the American. For parents with children aged 5 and younger the Child Tax Credit for. 21 2021 1100 am.

Among other changes the CTC was increased this year from 2000 per child to as much as 3600 per child as well as extended for the first time to families who do not typically.

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Parents Guide To The Child Tax Credit Nextadvisor With Time

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit What Is Childctc Marca

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities